Speculative Perspective: Mr. Profit

11/10/2019

An ecology exists within traditional academic environments. Over time, the model of one teacher (the provider of knowledge) and several students (the sponges of knowledge) gravitates towards a power structure that weakens both parties. The power moves from teacher and student benefiting each other to a resource extracting infrastructure (bureaucratic profit seeking behavior). To give some personal background information to the reader, I grew up in a rural town, Delta Colorado. The town relied on an economy of agriculture, forestry and coal mining. My Father worked with outside large institutions (Land of Lakes, World Bank) as an agricultural economic consultant. A large part of his time was spent overseas in developing countries, such as Nepal, Pakistan, and Kenya. My Mother, a marriage and family therapist, planned trips over the summer to visit my dad overseas. I state this background as a means to establish a human based perspective on the micro (the small town) and the macro (world travel). I encountered the traditional educational system for the first 11 years of my life. On the 9th year a utility took place once I met Mr. Profit. The school hired Mr. Profit to bring ideas from the home, and learning through play. The classroom consisted of a bank of computers to play strategic co-opetition games with other students against the computer. We read books and magazines aloud (a basis of hearing the same thing), then discussed the material through interpretation in a group format. The space also included a couch with an area of interactive puzzles. Mr. Profit had a teaching style that encouraged learning through experience and observation. However, Mr. Profit had to adapt his philosophy of learning into the traditional model of the school. This meant adapting a teaching approach of forced memorization. The intent being short-term measurement of test taking ability. The results impacting the funding allocated by the state. Mr. Profit’s ethical and moral compass was tested, he ended up leaving.

After moving on from Mr. Profit’s educational structure to a traditional middle school structure, I was back on the conveyor belt of society – it brought me back to an unpleasant reality. The next 2 years I sat in a sterile, front and center classroom with composite wood desks aligned in military fashion. The teacher’s desk; solid oak, thick, bold, front and center of the classroom, embodied a rigid learning environment. My role in this model was established before I placed pencil to paper. Small towns (a micro indicator) can be a predictor of the future on a faster time horizon. Resource allocation plays out more quickly. For example, when a family extracts resources for a living within the community, it is much more visible, acceptable, and the identity of that member is known by all. The binding of identity to the individual should lead the wealthy class to keep the community happy. However, community association is perspective based. Community for the wealthy often consists of law enforcement, government officials, and school administration. On a macro level the traditional learning system relates to the business industry. The American ideals of wealth growth take importance over future generations, trading short term gratification for long term results. A phenomenon comprised of customer buying behaviors, debt accumulation and short life cycle product curves. The system benefits go to the controllers of resource access (e.g. building infrastructure, channels of communication… bureaucratic authority). An incentive to take risk on new ideas does not exist for these individuals. Risk is positional anxiety.

How the institution is administered is only part of the issue in the system. The family dynamic also plays a large role. A student is not free to make decisions about their own education, resulting in another perspective issue. The parents tightly hold the idea of the traditional system, it worked for them, so that must be the best way for the child (a “safe” decision). The parents who have accumulated resources are more likely to want to keep the status quo. Unfortunately, they also hold status as agents of change. What is their incentive to change the system? Freedom of student choice is the future. After my encounter with Mr. Profit, I choose to exit the system and discovered a charter called “Vision”. My daily work schedule as a thirteen year old existed in front of a computer screen observing group behavioral patterns in financial systems, and studying digital wealth creation in free market games based out of South Korea. The economic game involved buying and selling in-game assets to then sell for US dollars. I knew what interested me. My time devoted to this exploration of games provided a personalized road map to an individualized educational framework. I was central to my own education. I would look for information to benefit my interests, without being forced too. Information begets more information, and I understood that knowledge growth happens through individual curiosity. My learning objectives were self-designated and highlighted. I was no longer trying to memorize information for the monetized benefit of standardized institutions. A society built ignoring cognitive interests creates sub-par skills, and it masks untapped talents. I create my own standard, instead of a standard being placed upon me.

If people are truly individual, then individualized learning is now. Students and teachers are peers in observation and measurement. Teachers exemplifying importance in presentation, rather than dictating through bureaucratic assignments. A society, built upon highly focused skills and knowledge, creates dependence on community. Individuals become tools of knowledge. Equity in the future exists at the point beyond standardization of the masses, to a focusing on individual free choice. Are we Profit’s?

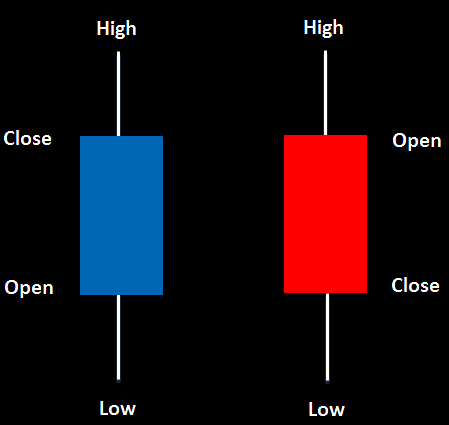

Homma Munehisa (1724 - 1803) - Developed the candle stick chart representing the Yin (bear market) and Yang (bull market) of stock market data.

The first rule in speculation is: Never advise anyone to buy or sell shares. Where guessing correctly is a form of witchcraft, counsel cannot be put on airs.

The second rule: Accept both your profits and regrets. It is best to seize what comes to hand when it comes, and not expect that your good fortune and the favorable circumstances will last.

The third rule: Profit in the share market is goblin treasure: at one moment, it is carbuncles, the next it is coal; one moment diamonds, and the next pebbles. Sometimes, they are the tears that Aurora leaves on the sweet morning's grass, at other times, they are just tears.

The fourth rule: He who wishes to become rich from this game must have both money and patience.

-Joseph de la Vegas, Confusion of Confusions